Part-I on this series will analyze the current state of the US book publishing industry -the key players, the value chain and profit distribution between the various players and rules that define competition within this industry.

Part-II will address the key challenges and strategic choices confronting both established and new entrants as EBook adoption accelerates. Will the EBook value chain differ significantly, how will incumbents react and who will come to dominate the landscape. Will EBooks lead to a new winner like Apple in digital music. If not why not.

US Book Publishing Industry Dynamics:

Book Publishing is essentially a “Hit-or-Miss” game of chance.Much like the movie and music industry the following rules apply:

-

Sunk Cost Rule – All of the cost of putting together and publishing a book is fixed and up-front. Irrespective of how the book is received the costs cannot be recovered.

-

Hit-Books Rule – There is no proven formula that will guarantee that a book will be a runaway success before its publication. Sales from a few “Hit Books” cover up for lost revenues from other not so successful books. The ratio of “Hit-Books” to “Failures” varies between 3% to 8%.

-

Franchise and Brand Name Rule – A few well known authors enjoy cult like following based on their previous works or series of books. The lure of astronomical sales leads to a frenzy among publishers to find and sign up big name authors.

-

Deep Pockets Rule – Only those publishers who can sustain multiple failures for the chance of few elusive hit stand to survive. The result consolidation, enormous bargaining power and leverage enjoyed by book publishers.

-

Retail Network Rule – Selling books requires a deep network of established relationships with book sellers and big retailers. Retail shelf space is highly contested for. Retailers have gained enormous clout from consolidation in the recent years.

-

Book Returns Rule – The practice of allowing book sellers to return unsold inventory first instituted during the Great Depression continues till today. Book returns run as high as 20% for publishers.

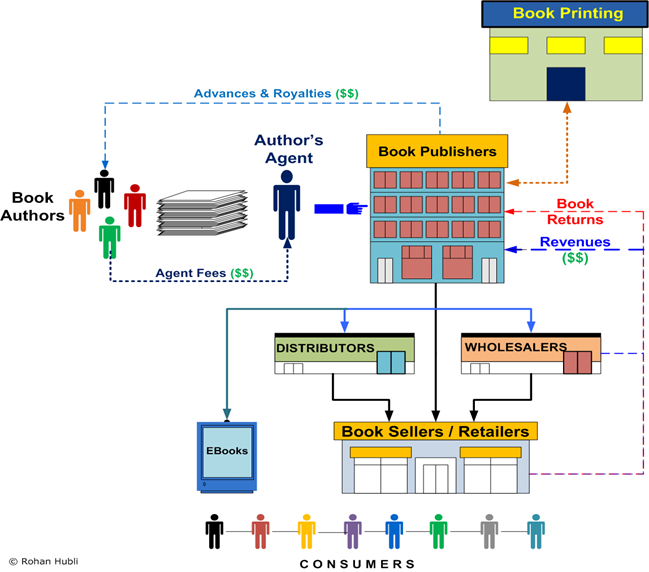

Stakeholders in the US Book publishing industry:

- Book Publishers

- Book Authors and Book Agents

- Book Sellers, Retailers and Distributors

- Buyers( Consumers, Institutional Buyers and Libraries )

- Service Providers ( Printing, Marketing, Logistics )

The US Book Publishing Industry – Value Chain

Across the value chain, US Book Publishers and Retailers enjoy significant clout and power base when it comes to negotiating prices, striking deals, managing access to resources, cultivating readers and promoting self interest.

Distribution of Profits across the US Value Chain:

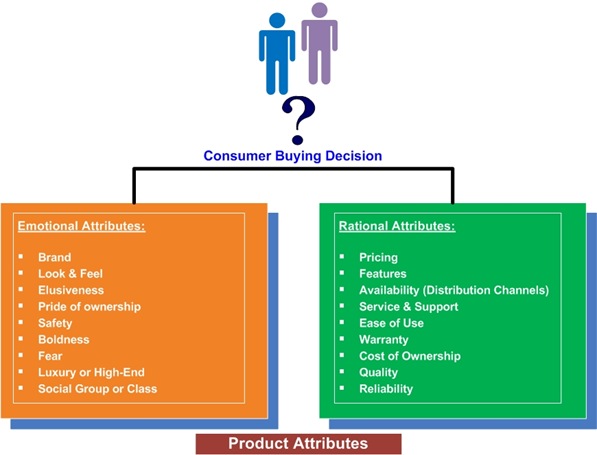

The distribution and allocation of profits (Print Books) across the US Book industry is skewed in favor of those intermediaries that can offer customer something they value, influence sales and offer value added services.

Pre-Production costs include the costs of writing, editing and reviewing manuscripts. The printing costs include the cost of physical paper, artwork and binding the book. This cost varies depending on the book size, number of pages, and illustrations used.

The publisher’s overhead includes the cost of maintaining a staff of editors, proofreaders, book designers, publicists, sales representatives and so on.

Marketing and promoting the book is another expense that include printing catalogs, media and print campaigns, sending out review copies to critics, arranging a promotion tour with the author and trade promotions for retailers all add up the cost of bringing a book to the market.

For retailers there is additional cost of operating and staffing the store, allocating shelf space, stocking the book, maintaining inventory and servicing customers. To a certain extent they can exploit economies of scope in buying and selling books.

* Assumes a hardcover book with a retail selling price of $29.95

The two powerful groups- “Book Publishers and Book Retailers” who stand to lose the most, with any disruption in the status quo, will explore all possible avenues to retain control over the emerging EBook ecosystem.

US Book Sales Market Size:

Forrester Research puts the overall size of the US book market at around $25 Billion. Books Sales between 2002 and 2008 have varied from a low of $22 Billion to a high of $24 Billions at a compounded annual growth rate of around 1.6% in the same period.

Over time a good chunk of that is going to migrate towards EBooks.

Total book sales fell 2.8% in 2008, to $24.2 billion, according to preliminary estimates released by the Association of American Publishers.

The top categories which dominate book sales today are:

- Adults and Children’s Books (33%)

- Elhi-Elementary, High School Books (25%)

- Professional Books (14.25%)

- Higher Education – Post Secondary (15.57%)

The question confronting Book Publishers- Which category renders itself the most vulnerable from the threat imposed by EBooks.

Book Buyers: Who are they ?

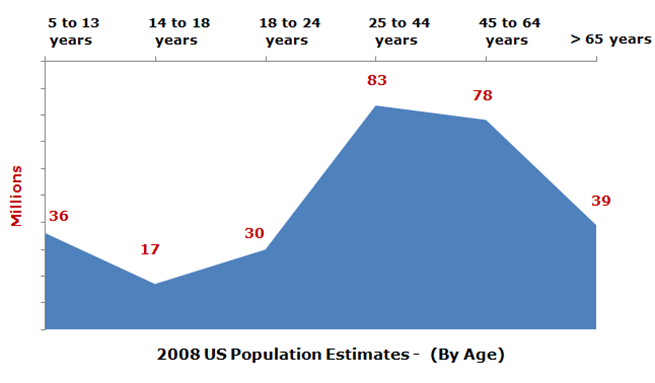

According to BISG, people above the age of 50 buy more than half of all books. The older demographics of devote book readers have disposable incomes and time to read (stable customer base).

The demographic breakdown of book buyers based on 2008 population estimates puts the total market size in this segment to around 110 Million. As a customer base this segment is very important and cannot be ignored.

The other major group comprises of school and college students: children, teens and younger adults. As a customer base they have the shortest lifespan correlating with the stage in their lifecycle. A few perhaps could evolve as avid readers later in their adult life.

Year

|

Elhi Enrollment |

% Growth |

Postsecondary Enrollment

|

% Growth |

|

2008 |

55,879,000 |

N/A |

18,200,000 |

N/A |

|

2009 |

56,116,000 |

0.42% |

18,416,000 |

1.19% |

|

2010 |

56,400,000 |

0.51% |

18,613,000 |

1.07% |

|

2011 |

56,781,000 |

0.68% |

18,822,000 |

1.12% |

The challenge than for Book Publishers grappling with strategic initiatives on how to face the threat imposed by EBook adoption and penetration boils down to the following:

-

People above the age of 50, your most valuable customer base is not going to change their years of reading habits. A few perhaps YES but the vast majority will continue to consume books the old fashioned way – print bound. How to position EBooks within this segment.

-

School and College Students, you can change and influence their book reading behavior during the formative years. The question arises who will invest and how much to promote EBooks in a big way. Access to this segment is controlled via powerful decision makers – departments heads of schools, colleges and universities, state and federal education boards.

References:

- Association of American Publishers

- National Association of College Stores

- US Census Data

- Book Publishers websites and SEC filings.

- PWC: Global Entertainment and Media Outlook: 2008–2012