Advanced Packaging- Enabling Next Generation Silicon Chips

Software Defined Vehicle-A Strategic Roadmap

References:

- https://www.statista.com/outlook/mmo/passenger-cars/luxury-cars/worldwide#unit-sales

- https://www.oica.net/category/sales-statistics/

- https://www.blumeglobal.com/learning/automotive-supply-chain/

- https://medium.com/next-level-german-engineering/porsche-future-of-code-526eb3de3bbe

- https://www.osvehicle.com/how-many-sensors-are-in-your-car/

- https://www.juniperresearch.com/blog/december-2021/the-rising-demand-for-automotive-sensors

- https://www.counterpointresearch.com/promising-yet-challenging-market-self-driving-socs/

- Revealing the Complexity of Automotive Software, Volvo Automotive Group (2020)

Datacenter Optical Transceiver Market

IoT Asset Management Solution: Trucking & Fleet Management

A high level architectural view of an IoT Asset Management Solution built from ground up to address the needs of different market segments.

The end use for Trucking and Fleet management tries to address the following key requirements:

- Low Cost Solution.

- Real-Time tracking even when faced with intermittent connectivity.

- Reliability to handle the most demanding terrain and environment.

- Scalable and Adaptable to accommodate various use cases.

- Security to prevent tampering and unauthorized access.

Asset Tracking & Management: An IoT Strategic Imperative

One of the most compelling use cases in IoT is in the area of Asset Tracking and Management. Asset classes can range from living, nonliving, transitory, stationary, remote to the accessible. An Asset Tracking system designed for one asset class can rarely be redeployed for another asset class as is. Each of the use cases and application scenarios are different and unique.

A further challenge to the emergence of a single dominant platform for managing assets is the heterogenous nature of assets that firms typically employ, even within the same industry. Therein lies the challenge of developing an Asset Tracking system; necessitating a multifaceted approach across various disciplines.

Wastage in Businesses – Inefficiency or Cost of Doing Business?

Every year businesses across all sectors of the economy lose billions of dollars on account of the following:

- Excess Inventory on hand.

- Low Asset Utilization and/or Asset Loss.

- Non-identifiable, Non-trackable and Perishable supplies.

- Labor costs associated with idling and/or unnecessary hauling of equipment.

- Line stoppages and business interruptions due to missing supplies and/or equipment breakdown.

- Cost of expediated transportation.

The above challenges need a systemic approach to tackle the inefficiencies, but you can’t fix what you don’t know.

Asset Tracking System: A Strategic Imperative

Activist investors are pressuring mismanaged firms to undertake a strategic review of how their businesses are run. During the 2017 proxy season, activists launched 327 public campaigns against U.S. companies, with $121 Billion1 under their management. Firms needs to proactively identify areas of weakness in their sphere of activities and call for a course correction.

Here are a few examples where the use of Asset tracking can unleash hidden value, eliminate waste and increase overall efficiency:

- In Los Angeles and Long Beach, California home to the busiest container ports in the USA, average truck turn time is around 82 minutes.2

- According to a 2017 study by National Retail Federation U.S. businesses lose around $50 billion annually to retail shrinkage.3

- Transportation delays in-transit and on customer premises will cost US chemical manufacturers an additional $22 billion in working capital on account of additional inventory held.4

- Annually hospitals lose 20% of their equipment. Historically asset utilization in US Hospitals has stayed around 40 percent, which means valuable assets such as IV pumps sit idle 60 percent of the time.5

- In the USA, an average city water utility loses 30 percent of the water supplied through leaks or un-billed usage.6

Asset Tracking System: A Competitive Advantage

The Internet has played an important role in the creation of new products-ideas, their diffusion and in levelling the playing field across firms and industries. Gone are the days where quality management systems such as TQM and Six Sigma enabled firms to leap frog competition.

The basis for competition in the hyperconverged world relies on achieving better quality with greater agility, easier provisioning and lower administrative costs. It’s imperative for firms to adopt a system wide view of their activities from procurement, design, manufacturing, operations, delivery, installation to use.

A firm that can leverage enterprise knowledge, integrate best practices and leverage asset tracking data can acquire a competitive advantage over its rival. To get there, firms need to invest on a platform that can leverage multiple data points and in-house knowledge to unlock hidden value.

Asset Tracking: Passive, Active or Intelligent?

At the basic level passive asset tracking involves nothing more than an electronic label and reader (e.g. RFID, NFC). One level higher is Active Tacking which entails connectivity, LBS (Location Based Services) and some form of a sensor coupled to a power source.

An intelligent asset tracking solution adds an extra layer of complexity with On-Board Monitoring, of one or more parameters of interest. Applications that require Real-Time resolution can now handle extreme events and undertake preventative actions.

Asset Tracking and Management – The Six Critical Elements

A compelling Asset Tracking solution requires the delicate act of balancing six critical elements – Sensors, Location Based Services (LBS), Connectivity, Power Consumption, On-Board Monitoring and Analytics.

- Sensors: The one analogy that I can think of when it comes to sensors is blood. Like blood, sensors serve three main functions: convey, protect and regulate the asset under observation. Sensors comes in all shapes, forms and functions the choice depends on what one intends to monitor, control and prevent.

- Location Based Services (LBS): For assets confined within a certain geographic radius (e.g. hospitals, warehouses, factory floor) one can assign fixed location identifiers or use triangulation (aided by beacons) to pinpoint location. If the asset under consideration involves a moving target (e.g. trucks, drones, mining equipment, shipping containers) that requires real-time monitoring one can select GPS or A-GPS (lower battery drain).

- Connectivity: The choice of connectivity often boils down to the tracker location (local vs. remote) and mobility (stationary vs. transitory) constraints. Additional requirements stem from network reach and coverage – PAN, LAN, MAN or WAN. The choice for a reliable connection range from NFC, Bluetooth Low Energy (BLE), ZigBee, ZigBee-IP, IEEE 802.11ah, WLAN to LPWAN (SigFox, LoRa, RPMA, Symphony Link, Weightless, NB-IoT, LTE-M). To offset some of the limitations arising out of cost, security and low power consumption gateway devices are often deployed for last-mile connectivity.

- Power Consumption: One of the key design metric in deploying trackers is whether to be battery or grid powered. For remote or unreachable applications, the choice is often forced. Additional constraints that dictate power usage include -Always ON, Alive When Spoken To and Periodic Awake.

- On–Board Monitoring: Applications that demand real-time monitoring have an additional constraint: take preventative or corrective actions before it’s too late. In battery powered devices there is a critical requirement to eliminate redundant data transfers or aggregate sensor readings. Both these scenarios call for an On-Board monitoring system.

- Analytics: What good is any data if you can’t act on it. The real value in any asset tracking system is knowing how to develop real-world solutions based on the insights gathered. The applications are numerous but just to list a few – Overall Equipment Efficiency, Defect Monitoring & Classification, Predictive & Preventative Maintenance, Trend Analysis and the holy grail using Machine Learning and AI to uncover hidden value.

A follow-on post will look at how various technologies can be leveraged and integrated to build a solution from ground up, specifically for the trucking industry.

References:

- The 2017 Proxy Season, Published by J.P. Morgan’s M&A Team, July 2017

- Average Monthly Truck Turn Time, Harbor Trucking Association, 2015-2017

- National Retail Security Survey 2017, NRF

- Transporting growth: Delivering a Chemical Manufacturing Renaissance, American Chemistry Council, March 2017

- Industry Survey: Transformative Technology Adoption and Attitudes—Location Technologies, ABI Research, 2Q 2017

- Smart Water Network, Navigant Research, 2016

- Prince, Jeffrey and Simon, Daniel H., Has the Internet Accelerated the Diffusion of New Products? (April 1, 2009).

Acknowledgements:

In fond memory of Rev Fr. Agnelo Pinto and Rev Fr. Pat D’Lima whose guidance during my adolescent years at St Paul’s High was instrumental in shaping who I am today.

Product Management: It’s more than just MRDs and PRDs

Every successful product should have a Marketing Requirements Document (MRD)and a Product Requirements Document (PRD) that together define the overall purpose, scope and goals for the product and its stakeholders – the firm, its end customers and its shareholders.

Product Management: Achilles’ heel

Very few companies, champion internal processes or a work culture where product management is given the importance it deserves. Product Management often gains prominence when the product has been commoditized or when the industry is maturing (decline). The exception to the rule are medical device and biotechnology firms where regulatory requirements demand thorough book keeping.

In some firms a member of the marketing or engineering team helms the role of Product Management; such a role is replete with managerial hubris.

A good Product Management practice necessitates that the function of Marketing, Product Management, Engineering, Finance and Operations be distinct and separate, to avoid conflicts of interest and managerial bias (Group-Think, Self-Selection, Sunk-Costs, Representativeness, Availability, Risk-averse, Risk-seeking).

Marketing Requirements Document (MRD)

In my view the marketing team, in cohorts with strategic planning, defines the overall skeleton for the MRD (Marketing Requirements Document). In some firms this role is delegated to the office of New Product Planning and Innovation.

A good MRD is one that encompasses a well-defined market (market segments), outlines the revenue and profitability goals and defines the Go-To market strategy to make the product successful.

Product Managers should never own or be tasked with defining the MRD for two reasons.

- First, an inherent conflict of interest and self-selection bias will drive most PM’s into solidifying their role in the company.

- Second, the sole purpose of a MRD is to enact a system of checks and balances to review the overall performance, profitability and viability for the product or business.

Product Requirements Document (PRD)

A Product Manager uses the MRD as a blueprint to conceive the mind, body and soul for the Product.

PRD: Where do I start?

It is my firm belief that a PRD should be customer centric and not engineering driven.

If the product in question is backed by a revolutionary new idea, then ethnographic studies and focus groups are vital in shaping the PRD.

If the nature of the innovation is incremental then a treasure pile of correspondence between and among market participants (internal and external) is where you should start. If possible, immerse yourself into learning about the customer by joining the sales and marketing team on field visits.

A new product must justify its place in the marketplace. A comprehensive market review and competitive analysis that includes features, price, channels and promotion must be undertaken. In fact, I recommend every Product Manager to do this when he or she assumes a new position.

The use of multidimensional scaling and conjoint analysis are indispensable tools both when conceiving new offerings or streamlining existing products.

Functional Performance, Acquisition Cost, Ease-of-Use, Operating Cost, Reliability, Serviceability and Compatibility should dictate technology choices and the overall scope, form and shape of the product.

Recognizing your Stakeholders

Any successful product requires teamwork and the ability to bring together people towards a common goal. Inherent in any organization are power dynamics that come into play that need to be handled with tact and diplomacy.

A Product Manager will face various stakeholders, with conflicting goals, as the product moves from conception to commercialization.

- The finance team which green lights the project, approves development costs, allocates resources and evaluates profitability goals (upon release).

- The R&D, engineering and supply chain teams that work diligently to bring the product to life.

- The legal department in drafting-reviewing contracts and licensing terms with partners, vendors and suppliers.

- The regulatory and certification bodies who confer product safety and grant market approval prior to launch.

- The marketing, sales and support team who will promote, deliver and support the product as it gets adopted by customers.

- The corporate and strategic planning team who evaluate business performance and manage shareholder value.

Product Manager: A Lone Ranger

A PM is akin to a lone ranger fighting for the glory of his (her) product.

The ultimate responsibility for ensuring that the PRD and MRD converge; deliver value to the firm and its investors falls on the Product Manager.

The traits that I personally advocate a great Product Manager to possess are empathy, curiosity, humility, attention to detail, entrepreneurial, embrace uncertainty, foresighted and data driven.

Keep the Innovation Running, it’s the lifeblood that fuels humanity.

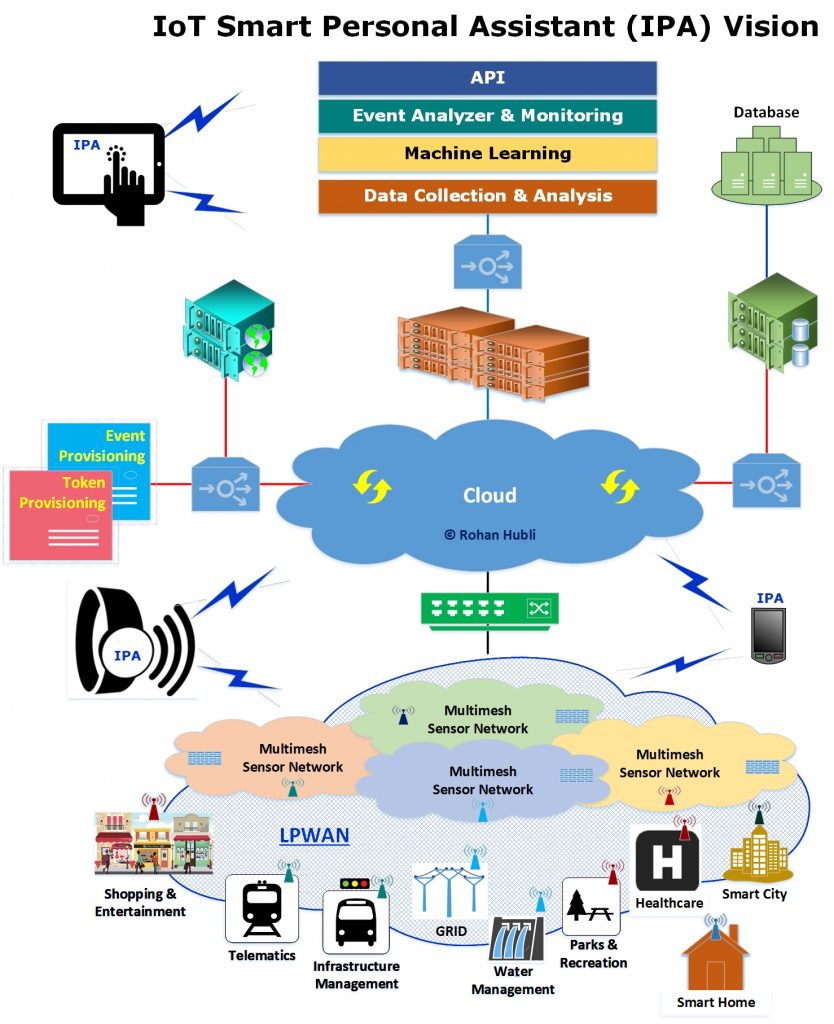

Vision for IoT Smart Personal Assistant

The current generation of Smart Wearables Devices (SWD) were primarily introduced as a companion device to the smartphone. As such, SWD’s offer nothing more than the added convenience of “usability of the go” and “small form factor“.

Most buyers, including me, question the wisdom of owning a muted version of a smartphone on their wrist; a key reason stalling wider adoption of SWD.

To find their rightful niche in the marketplace, SWD need to evolve from a smartphone centric device to a stand-alone IoT Personal Assistant (IPA).

Vision for IoT Smart Personal Assistant

In a follow-on post, I will outline my vision for a device coined “IoT Smart Personal Assistant (IPA)”; one that can enhance quality of life for its users and unlock hidden value for market participants.

Smart Water Monitoring – A Market Opportunity.

The Future of Semiconductor Business & Innovation

Abstract: The Life Cycle theory on industry evolution suggests that the rate of knowledge obsolescence tends to diminish over time. In effect it deters new entrants from entering the industry; the ensuing shakeout forces industry consolidation and concentration. The fallout; operational efficiency, product proliferation and price discipline take center stage.

In the semiconductor industry the very presence of technological knowledge obsolescence has prevented industry shakeout and consolidation up until now. However, with escalating costs and the fundamental limits on device physics reaching a climax are the curtains descending on the semiconductor industry. If so, what are the ramifications for the industry and its ecosystem?

Downloads:

- Future of Semiconductor Business & Innovation

- Fabless Semiconductor Chip Startup Business Plan

- Semiconductor SOC Design Cost Model

First a brief look at the semiconductor industry dynamics:

| 1. Semiconductor fabrication plants exhibit exponential cost dynamics. Rock’s Law, named after the visionary venture capitalist Arthur Rock, predicts that the cost of a semiconductor fab will double every four years.

2. Semiconductor Industry is characterized as having very high fixed cost, and low variable costs. 3. A cutting edge semiconductor fab has an active life cycle that lasts anywhere between three and five years. The cyclical nature of the industry results in periods of high capital expenditure interspersed with bursts of revenue streams. 4. Moore’s Law, named after the visionary cofounder Gordon More of Intel, predicts that the size of a semiconductor chip will shrink by half every two years (everything else remaining the same). 5. Semiconductor chips although very design intensive benefit heavily from division of labor. 6. Semiconductor design exhibits compelling scope economies due to cumulative experience and design knowledge. 7. Semiconductor design is susceptible to significant knowledge obsolescence within domains. 8. Process and Product Innovation both happen at the same time. Firms either acting alone or together orchestrate process innovations that the entire industry draws upon. Product innovations on the other hand are firm specific. 9. The industry is highly competitive with low barriers to entry. However tacit knowledge and market reputation favor both scope and scale economies. |

Semiconductor Value Chain and State of the Industry

As of 2011, worldwide semiconductor sales attributed to IC’s and components reached $299.5 Billion. The market is fragmented across all sectors except in the area of microprocessors were a duopoly exists. The worldwide pure play semiconductor foundry market totaled $29.8 billion in 2011. The top five foundry players accounted for almost 80 percent of the foundry market share.

Electronic Design Automation (EDA) vendors accounted for revenues of $4.19 Billion in 2011. Semiconductor chip design, verification and implementation tools accounted for almost 90% of this market, with the rest owned by PCB design tools.

The market for semiconductor IP registered sales of $1.58 Billion. Design Services made up another $350 Million in revenue for 2011. IC Packaging and Assembly generated revenues of $13.9 Billion and the embedded software market registered sales of $1.2 Billion. Semiconductor FAB’s demonstrated revenues of $29.8 Billion in 2011.

Across the value chain semiconductor chip companies and semiconductor FABs account for the lion share of the revenue. The former exploits economies of scope and the latter economies of scale.

Revenue Drivers

Cost & Value Migration

An amalgamation of processor cores, feature rich IP and fab for hire have pushed the value frontier to a new normal. Aided by quantum jumps in feature size and design productivity, SOCs redefined products and markets.

The first generation of SOC’s saw processor, peripherals, interfaces and memory integrated. The second generation of SOC’s built on the previous by harnessing multiple cores, RF and power management functions. The third generation of SOC’s will bring together photonics, high density memory and MEMS into the main stream.

Cost Performance Ratio, SOC’s – The New Normal

Cost Performance Ratio, SOC’s – The New Normal

On the value frontier, a leading edge System-on-Chip (SOC) offers cost-performance ratio that rivals the elite microprocessors of today. The new players with vastly different business models are increasingly threatening the old guard. However both have seen semiconductor design costs reach epic proportions.

With increasing levels of integration and multicore processors becoming the norm, hardware and software costs have exploded. Verification engineers and software developers now covet over half of the development team. As geometries shrink, tooling efforts to account for increasing variability of parameters and DFM (Design for Manufacturing) requirements have further exacerbated the problem.

The Economics of Chip Design

A typical semiconductor company spends anywhere from 20% to 25% of its revenue on R&D with COGS accounting for another 40%-45% and SG&A in the region of 10% – 15%. With these assumptions and using the Semiconductor Chip Design Cost Model the numbers that emerge tend to favor products that can be milked over relatively large periods of time or in markets with large demand side economics of scale.

To put things in perspective, the annual shipments of microprocessors (all segments) in 2011 stood at 350 Million units. High-end smartphone shipments reached 60 million units in 2011. The returns necessary to justify investment on a new chip requires double digit market share.

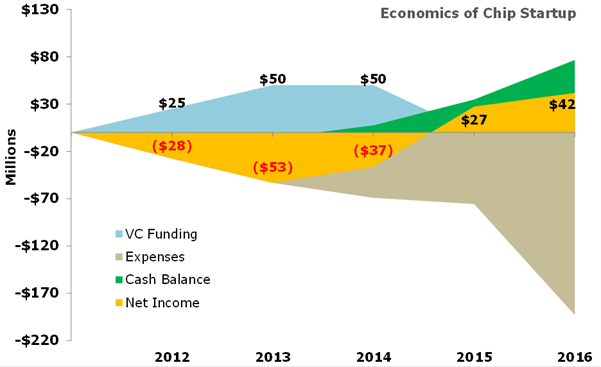

Fabless Semiconductor Startup:

The picture is no different for emerging startups wanting to unleash the next biggest idea or invention. Although startups rely on VC money to fuel R&D in the initial stages the return necessary to justify venture investment are increasingly out of reach for many.

A semiconductor startup pursuing an opportunity in a fast growing market needs to capture more than 10% market share and demonstrate higher probability of success. To deliver both, the odds are as good as winning the lottery. (See: Fabless Chip Startup Business Plan)

Startup Exit Valuation:

Note: Startup is funded, based and operates solely out of USA

Implications for Product Innovation

It is imperative for designers to leverage legacy designs, in die form, surround them with abundant memory and unleash rich software to create value. New alternatives in 2.5D packaging (side-by-side die on an interposer) or 3D packaging (Through-silicon-Vias) will aid this effort. Many low to medium volume applications will make this transition. OEM’s in commodity markets will increasingly adopt COTS and rely on ODMs/EMS to bring solutions. Software will be the basis for differentiation.

For high volume applications the next wave of innovation will require products that can integrate wider range of heterogeneous functions (mobility, sensing, intelligence, adaptability and connectivity).

The market will essentially evolve to provide one or all of the following functions- Intelligence, Connectivity, Stimuli and Gratification in varying degrees. A chip that can integrate all of the above functions and satisfy the needs (price/performance) of the market will unleash major realignment and shakeout within the industry.

| Imagine a TV in the not so distant future that morphs into a Gaming Console, a PC, a Web-TV or an entertainment hub based on the need. Embedded Hardware Virtualization will make this happen and enter mainstream market in a big way. |

Intelligent Devices constitutes another market area with a potential volume larger than PCs, Mobile Phones, Servers, and Tablets combined. With a 2020 vision of 25 Billion devices the market requires Sensing, LBS, Augmented Reality, Analytics, Security and Self-Monitoring to be prevalent in most nodes. A platform centric vision for intelligent nodes can unleash innovation and propel existing players to new heights.

We are entering a realm of devices capable of features analogous to what we humans are born with. Ironically most humans share the same feature set. It is the DNA that confers uniqueness and character. For chips, with similar features, software will emerge as the key differentiator and enabler that can morph into something unique depending on the context.

The Road Ahead

Globally the aging population (65+) will grow to 2 Billion by 2050. The world’s emerging middle class will reach 4.9 Billion by 2030. Developed and emerging economies share of the middle class will reverse from the current 50% to 22%. A slow-cycle market characterizes one and a fast-cycle market exemplifies the other. The challenge lies in managing both at the same time and within the same organization.

1. Industry Concentration: The minimum efficient scale (MES) for a semiconductor fab is nearing $10 Billion. For a fabless chip company the ratio of minimum sales volume (MSV) to market size has reached double digits (~15%). As platform products and services, with winner-take-all dynamics, become more prevalent, the industry will consolidate. Firms either need to pursue broad line differentiation or risk being caught in the middle where the future is anything but certain. Each market vertical will converge to the “Rule of Three” with an uptick in M&A based on horizontal product line reach.

2. New Business Models: The new winners will be those who can enrich customer captivity (combination of switching and search costs) and combine it with supply side economies of scope. The industry will favor fast-followers and late adopters over innovators. An asset lite model supplemented by just-in-time design methodology and standardized hardware platform with software differentiation will redefine competition.

3. Vertical Integration: OEM’s will be forced to ensure that their semiconductor suppliers remain viable and continue to create value. Some form of vertical integration either in the form of minority stake, multi-year supplier partnership or outright purchase will become a necessity. Pure play foundries and EDA specialists will integrate forward to offer one stop R&D solutions by assembling a portfolio of IP’s and engineering resources. At the technology level high density Memory (3D), MEMS, Interconnects, Photonics and Embedded Software are prime targets for M&A.

4. Operational Efficiency: Ultimately all firms needs to generate returns that cover the cost of capital. The less efficient companies will struggle merely to remain afloat. Efficiency governs all activities from engineering, production, marketing, sales, to operations. The organizational power structure, long the bastion of engineering, will cede control to marketing and finance. ROIC the new mantra.

5. R&D: Escalating costs, will force many chip companies to offshore R&D. In the next five years leading edge designs, the stronghold of Silicon Valley will move overseas as markets there become large. Many companies will transform their model to one of an IP provider. Foundries, the current gateway for all semiconductor chips will move up the value chain to offer one stop solutions as will EDA companies. Development of process technology for new nodes will require pooling of industry resources together.

6. Value Migration: For firms to generate economic profit it is imperative to adopt a software centric vision for the products as value migrates from hardware to software. Firms that can package and deliver hardware-software together will remain immune to commoditization and reap the benefits of lock-in and network effects. If you are somehow not plugged into one of the platforms, competition will force you out.

Closing Remarks:

As the economics of semiconductor business undergoes fundamental shift, changes in the value chain and ecosystem is inevitable. To sustain economic profits exploiting economies of scope in R&D resources will become critical and challenging. One business model that could disrupt the industry is “Just in Time Design” harnessing elements from Dell’s supply chain model and Toyota’s production management system. When transaction and search costs associated with semiconductor Intellectual Property and Engineering Talent intersect on an EBay like trading platform the vision will become a reality.

References:

- Semiconductor Annual Revenue Data sourced from WSTS, April 2012

- EDA Annual Revenue Data sourced from EDA Consortium MSS Newsletter, Q1-Q4 2011

- Semiconductor Foundry Market Data sourced from Gartner, March 2012

- Processor Market Shipments by Industry and Architecture, IDC, February 2012

- Semiconductor Industry Profitability Analysis based on financials from 2007 – 2011 of Top 10 players in each category excluding outliers. Data compiled from Annual reports, Morningstar, Bloomberg and SEC filings.

- 2011 PC Shipment Data, Gartner, January 2012

- 2011 High End Smartphone Shipment Data, Berg Insight, February 2012

- Intelligent Systems, The Next Big Opportunity, IDC, August 2011

- World Population Aging, United Nations

- World’s Emerging Middle Class, sourced from Dr. Homi Kharas, The Brookings Institution,

- Global Semiconductor Alliance, March 2012

- EDA Consortium, Quarterly Marketing Statistics (2011). Market Research Reports

- ChipSTAT Annual Review, April 2011

- NASSCOM, Opportunities in Embedded Software (2010)

Acknowledgments:

To my colleagues and peers in the semiconductor industry with whom I have shared and enjoyed an incredible journey. Your inputs on the Survey are highly appreciated. Thank You for taking the time to answer it.